Every CEO and marketing leader at every B2B company wants to grow and is desperate to learn what steps they need to take to achieve that next level of growth. Should we refresh our brand? Do we need to redesign our website? Maybe we should double our investment in content marketing.

All of those efforts are premature and of little value if you do not possess a deep understanding of who your best customers are, where they are, and what and how to communicate with them. In this blog, we’ll tackle the first step in gaining a deeper understanding of your customers by showing you how to create your ideal customer profile. Let’s get started.

First, before we delve into how to create your ideal customer profile (ICP), let’s make sure we all understand what an ICP is, what it is not, and why defining an ICP is worth the effort.

Ideal Customer Profile (ICP) noun

A description or collection of common firmographic, technographic, and behavioral attributes as well as goals and pain points of companies most likely to find value in your product or solution, purchase from you, remain a loyal customer, and tell others about you.

What is an Ideal Customer Profile (ICP)?

For a B2B company, an Ideal Customer Profile (ICP) defines the common firmographic, technographic, and behavioral attributes as well as goals and pain points of the companies most likely to find value in your product or solution, purchase from you, remain a loyal customer, and tell others about you. Think of your ICP as your quick reference cheat sheet reminding you of which companies you will have the most success with and should focus on to grow more quickly.

For B2B companies an Ideal Customer Profile is focused on the types of companies you will be most successful with, not the individual consumers. You may wish to refer to this as your Ideal Company Profile.

You may have noticed that demographics were not included in our definition of what constitutes an ICP. Demographics are included in B2C ICPs but are intentionally not included in B2B ICPs because the emphasis is on the company, not the individual consumer. For those at B2B companies, an easy way to remember this company focus is to change the acronym a bit and refer to it as your Ideal Company Profile.

You may be asking, "Aren't those demographics important to our marketing efforts?" Yes, they are. They are very important. Demographics like age, race, gender, etc. are incorporated into your buyer personas which help us tailor our messaging and offers to particular types of individuals at companies. We'll discuss buyer personas a bit later.

Don’t Confuse Your ICP with Target Customer, TAM, or Buyer Personas.

Target Customer vs ICP

So, you may be thinking that ICP sounds a lot like your “target customer”. While many use the two terms interchangeably, “target customer” is typically referring to any company that might buy your product or service while your ICP is focused on the most valuable of those prospects. These are the companies that are more likely to buy (more quickly), find greater value in your product, remain a customer longer, and become brand advocates.

Buyer personas represent individuals within your ICP and provide a deep-dive glimpse into their motivations, pain points, buying habits, online activities, and more.

TAM vs ICP vs Buyer Personas

Many also confuse ICP with TAM and Buyer Personas. Perhaps the confusion is because there is a distinct relationship between them. Your TAM or Total Addressable Market is the total market possible for your product or service. That includes customers that are happily using a competitor’s solution. Your ICP is a subset of your TAM identifying the best companies to sell to. Buyer personas represent individuals within your ICP and provide a deep-dive glimpse into their motivations, pain points, buying habits, online activities, and more. Your ideal customer profile lies in between your TAM and your buyer personas. Make sense? If not, hopefully, the animated GIF below, which changes between TAM, ICP, and Buyer Persona every 5 seconds, will make it more clear. It illustrates the shift in focus from all companies in the market to your ideal companies and finally, to specific people within those ideal companies.

Why Create an ICP? Where’s the Value?

Now, why even go through the trouble of creating an ICP? For many companies, producing an ICP is a mere formality, if done at all. It is often misunderstood or done incorrectly. Far too often, an ICP is a document saved in some shared marketing folder and resurrected only to show new, junior-level marketers during their first-day orientation (i.e. Look, we’re professional marketers. We produced an ICP document.)

That’s sad, because the reality is your ICP, if produced correctly, should be a foundational document shared throughout your organization to help gain alignment, focus efforts, optimize the sales funnel, and grow your business.

Here are some of the key benefits of nailing your ICP and actually using it:

- Align Product, Marketing, Sales, Success, and Exec Teams

- Focus on Scalable and Repeatable Strategies and Tactics

- Improve Targeting & Segmentation

- Optimize Limited Resources

- Increase Conversion Rates

- Shorten Sales Cycle

- Grow ACV and LTV

- Increase Referrals

Hopefully, you’re convinced, recognize the value of developing an ICP, and are anxious to build your own. Below are five steps to constructing an ICP that accurately reflects your best customers and provides value to your company.

5 Steps to Create Your Ideal Customer Profile

Ask ten different marketers how to create an Ideal Customer Profile and you’ll likely get ten different answers. They will all (or should), however, discuss finding out who your “best” customers are, listing out the common traits of those “best” customers, and putting these characteristics into a nicely-formatted document to be shared throughout the company. We’ll break down our five steps to creating an ICP so you can tackle this project and build an ICP for your own company.

Step #1: Identify Your Best Customers

Identifying your best customers is not a speculative exercise. Resist the temptation to swap out the word “customers” for “prospects”. We are talking about paying customers - companies that you’ve already won deals with.

Your job now is to go into your CRM and produce a list of your current customers, review the data, and identify who is getting the most value from your product. What criteria can you or should you use to distinguish a great customer? You can certainly go about this in different ways, but a fairly straight-forward method to identifying your “best” customers is to look at your quantitative data and isolate those that have renewed, have a higher than average annual contract value, and have given your company a score of 9 or 10 on your NPS (Net Promoter Score) survey. A customer that has renewed is an indicator they found enough value in your product to continue using and paying for it. Having an ACV above average indicates the customer recognizes the value of your offering without requiring special discounts to persuade them to buy. Finally, customers that have given you a 9 or 10 on your NPS survey love your company/product and are excited to share with others. You definitely want to tap into what is generating that level of excitement and satisfaction so you can create more brand advocates.

A good first-pass filter to identify your “best” customers is to isolate those that have renewed, have a higher than average Annual Contract Value (ACV), and scored you a 9 or 10 on your NPS survey.

You can certainly apply different and/or additional filters to get your “cream of the crop” customers. Get creative. Ask yourself questions like:

- Which customers move through the funnel quicker? (indicating they more readily understand the value your product provides)

- Which customers are using our product in multiple stores/locations?

Once you feel confident that you have narrowed your list down to your best customers, take a look at the list and see if you recognize any obvious patterns. Are your customers predominantly from one or two industries? Are they located in a specific geographic region? Are the companies of a typical size in terms of revenue and/or employee count?

Below is a list of some commonalities to look for among your best customers:

- Industry

- Geography

- Company Size (Revenue/Employee Count)

- Job Title/Role

- Pain Points/Goals

It’s fairly common to see your best customers are in specific industries, from particular geographic areas, are around the same size, and share common pain points. You’ll want to focus on these groups and select companies from within them to explore and understand them further.

Step #2: Talk to Your Best Customers

So you’ve already made significant progress in identifying your ICP by digging through your CRM’s quantitative data, but now is the time to add some qualitative data. There is simply nothing better than directly engaging your customers to uncover eye-opening insights that may never be found in your CRM.

I once worked at a software company that decided to introduce its product into a totally new market - home healthcare. We made some pretty logical assumptions based on known industry requirements and concerns, but as the old saying goes, to “assume” makes an “ass out of you and me”.

There is simply nothing better than directly engaging your customers to uncover eye-opening insights that may never be found in your CRM.

We had concluded our new home healthcare customers would embrace our product because of our HIPAA compliance and advanced security features. It was not until we asked our customers directly that we learned that those were just table stakes. We discovered that where they found the most value in our product was in its ability to handle and expedite an HR function for which they had limited resources. Once we understood this, we completely changed our value proposition and messaging which allowed us to engage with more qualified prospects, close more deals, and shorten the sales cycle. My purpose in sharing that story was to emphasize that some insights are simply not available in your CRM data and can only be revealed by directly speaking with your customers.

So your next step will be to set up in-person, video, or phone meetings with a user, influencer, and decision-maker at least 10-15 of the companies on your list. The goal of your conversions will be to learn more about their buying journey: what their buying process is like, how they discovered your solution, why they decided to purchase, and how they’re benefiting from your solution now that it is being used.

Below are a few questions you can ask to help learn more about your best customer’s buying journey:

- How much research did you do before making a purchase decision?

- Did a referral influence your buying decision?

- How did you first hear about our product or company?

- Who is the buying decision-maker at your company for our type of product?

- Did the buying decision need to be approved by others or go through a committee?

- What are the major pain points your company faces?

- What is the primary problem you were trying to solve?

- How does our product help you solve that problem?

- Why did you originally choose to purchase our solution?

- What benefits do you get out of using our solution today?

These are just some of the types of questions you should be asking. Your goal is to understand your customer’s:

- Pain points & primary problem

- Path to discovering your product/company

- Process for buying

- Use of your product to solve their problems

Step #3: Find Commonalities Between Your Best Customers

Good news! You’re done with the real heavy lifting. You’ve pulled your quantitative data from your CRM and collected pertinent qualitative data by interviewing your customers. Now it’s time to put it all together and find the commonalities among the data points collected. What do some of your best customers have in common?

- Industry? Geography? Size?

- Pain points? Problems? Goals?

- A similar path to discovery or buying process?

Step #4: Populate Your ICP Template

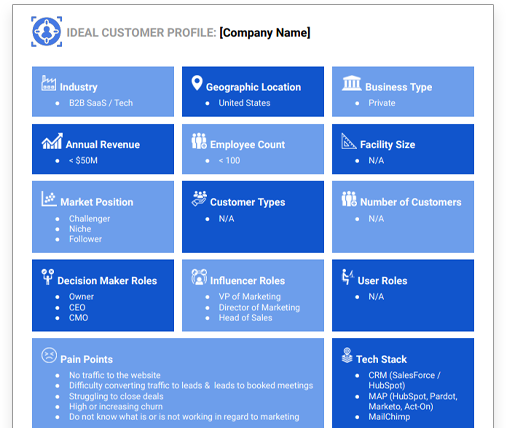

Now use all of the insights you've gathered to build your ICP document. Feel free to make your own document in whatever format works best for you. Just make sure the document can be easily shared and updated. I highly recommend using a Google Doc, Sheet, or Slide deck to build your ICP. These formats make it easy to share throughout your company and keep up-to-date.

To make it easier on you, we've provided a nice clean template for you to kickstart the process. You just have to fill in the document, change the colors to match your brand, and you've got yourself a professional-looking ICP document to share with the rest of your company. Click here to download the template.

Step #5: Keep Your ICP Up-To-Date

It’s important to keep your ICP up-to-date. Shifts in the market, changes to your product, and how customers find and engage with you can change over time and your ICP should reflect that. It’s a good practice to review your ICP every 6-12 months to ensure it is a proper representation of your best customers.

What Now? You Have Your ICP, What Do You Do With It?

You now have this great document that identifies the attributes of the companies that are your best customers. What should you do with it? For starters, don’t burry it in some folder on your laptop never to be seen again. The purpose of creating this document is not to check a box on the list of things good marketers do, but to provide a resource that helps your Product, Marketing, Sales, Success, and Executive teams align on where efforts and resource are best directed. It is to help develop winning strategies and tactics and improve targeting and segmentation. All of this will help improve conversion rates, shorten the sales cycle, increase referrals, and grow your company!

The purpose of creating this document is not to check a box on the list of things good marketers do, but to provide a resource that helps your Product, Marketing, Sales, Success, and Executive teams align on where efforts and resource are best directed.

Save this document into a shared directory. You want the entire company to have access to view this document and you’ll want to ensure they are seeing the most up-to-date version. Your ICP is a foundational document on top of which your marketing is built.

Conclusion

I hope that after reading this article you have a better understanding of what an Ideal Customer Profile is and why it’s so valuable to you as a marketer and to your entire company. I also hope that if you were hesitant to build your ICP for fear you might get it wrong, that these straight-forward and practical steps have given you the confidence to move forward and know you’ll get it right. You’ve got this!

Template: Ideal Customer Profile

The quick and easy way to build a professional-looking ICP. Why's your ICP important? It helps you:

- Align Product, Marketing, Sales, Success and Executive teams.

- Improve targeting and segmentation.

- Increase conversion rates.

- Shorten sales cycles.

Download Your Ideal Customer Profile Template

Template: Ideal Customer Profile

The quick and easy way to build a professional-looking ICP. Why's your ICP important? It helps you:

- Align Product, Marketing, Sales, Success and Executive teams.

- Improve targeting and segmentation.

- Increase conversion rates.

- Shorten sales cycles.

Download Template

Download Template

Get Growth Marketing Articles, Tips & Tricks

(sent directly to your inbox)

Template: Ideal Customer Profile

The quick and easy way to build a professional-looking ICP. Why's your ICP important? It helps you:

- Align Product, Marketing, Sales, Success and Executive teams.

- Improve targeting and segmentation.

- Increase conversion rates.

- Shorten sales cycles.

Download Template

Download Template